Buying Property in France

- Investment

-

Jan 27

- Share post

Buying Property in France: A Complete Guide for Foreign Investors 2026

How to Buy, Costs, Taxes, and Returns Explained

This guide explains, step-by-step, what an international investor needs to know to buy property in France in 2026. It covers purchase routes (new build, resale, renovation), the legal process (offer → compromis/promesse → acte authentique), mandatory technical checks, costs (notary/transfer taxes, VAT), taxation (rental income, capital gains, IFI), financing for non-residents, ownership structures (personal vs SCI), practical timeline and an investor checklist. Key legal and market facts are cited to official or specialist sources.

1. Why consider French property as an investor

- France offers large and liquid markets (Paris, Lyon, Bordeaux, Nantes, Nice, Toulouse and many secondary cities), a strong tourism sector and long-term capital appreciation in many locations.

- Legal protections for buyers are robust (regulated notaire role, formal contract steps and mandatory diagnostics), which reduces transactional risk compared with many other markets.

2. Three investor strategies — pros and cons

A. Buy resale (existing property)

- Pros: often better central locations, established neighbourhoods, immediate rental yield potential.

- Cons: higher transaction costs (transfer taxes / notary fees), likely short-term maintenance/renovation. Notary/transfer costs typically total ~7–8% of price for resale.

B. Buy new (VEFA / off-plan)

- Pros: lower acquisition costs (notary/registration ≈ 2–3%), builder guarantees (e.g., 10-year structural warranty), energy performance, temporary property-tax exemptions in some cases.

- Cons: VAT (TVA) often applies at 20% to new builds (so price may include VAT), delivery delays and developer risk (choose reputable promoters).

C. Buy to renovate (value-add)

- Pros: potential for highest capital gain and uplifted rental income; tax mechanisms (e.g., Déficit Foncier) can be favourable for renovation investors.

- Cons: needs project management, local permits, accurate renovation budgets and contingency funds.

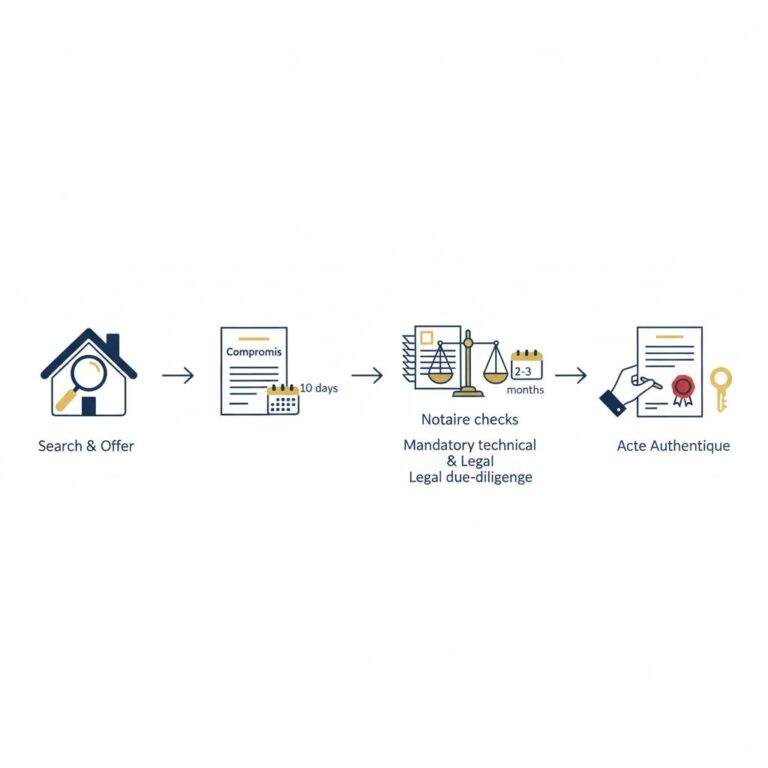

3. Typical purchase workflow and timeline

- Search & offer (weeks–months) — identify properties, request DPE & photo/video, verify copropriété documents if apartment.

- Preliminary contract: compromis de vente (bilateral) or promesse de vente (unilateral). Deposit commonly 5–10% (can be less for new builds). Buyer obtains mortgage offers during the conditional period.

- Cooling-off: the buyer has a statutory 10-day withdrawal period after signing the preliminary contract (no reason required).

- Conditions precedent: typical suspensive clauses include mortgage refusal and satisfactory legal/technical diagnostics. If mortgage is refused and a clause is present, deposit is usually returned; otherwise deposits may be forfeited.

- Notaire checks (about 2–3 months): title, servitudes, mortgages, fiscal status, planning, and registration searches.

- Acte authentique (final deed): signing before a notaire and payment of balance + fees; registration follows and ownership is recorded. Typical total process for resale: ~3–4 months from compromis to completion; new builds can take longer (delivery schedule).

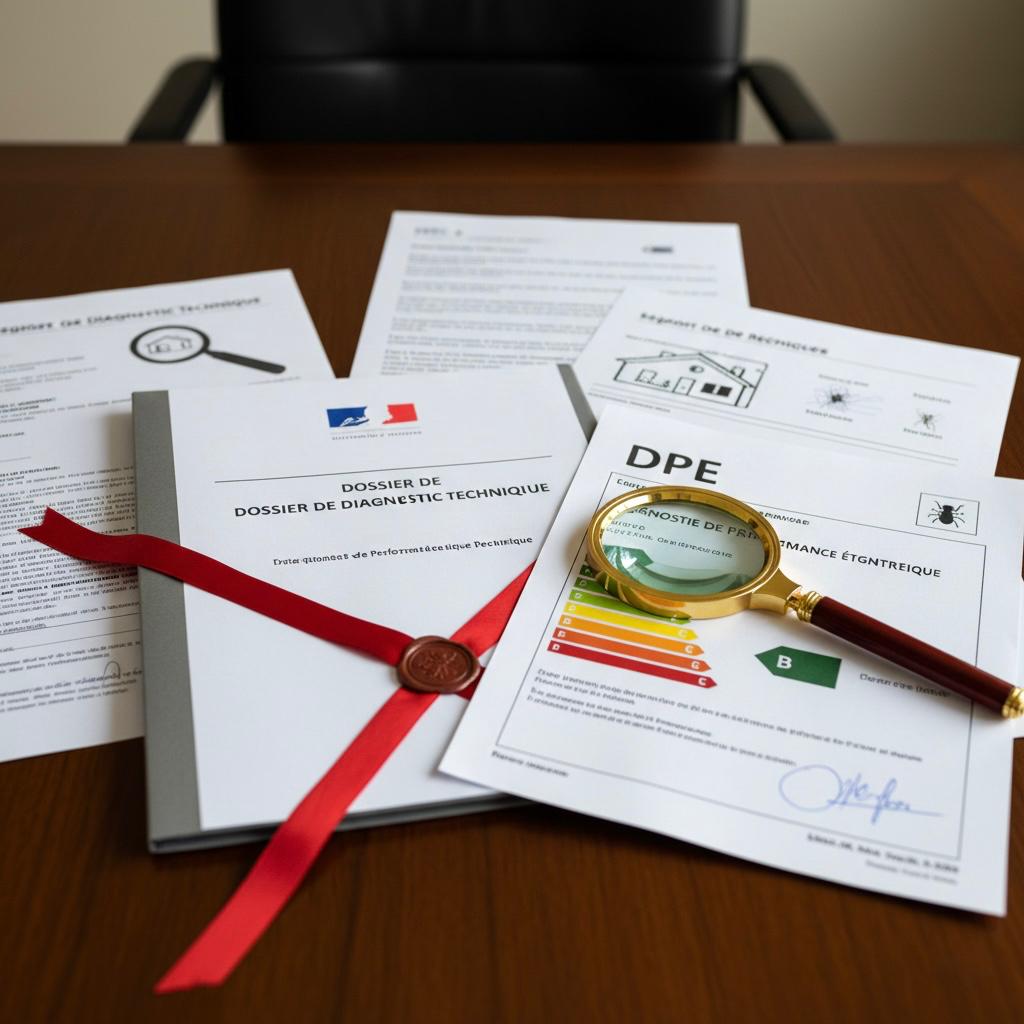

4. Mandatory technical & legal due-diligence (what must be provided)

Seller must supply the Dossier de Diagnostic Technique (DDT) — these reports must be attached to the preliminary contract and typically include:

- Energy Performance Certificate (DPE) — mandatory for all sales.

- Asbestos (if built before 1997), lead (CREP, if built before 1949), termite report (in certain departments), gas and electricity reports (if older than thresholds), natural/industrial risk map (ERNMT), and Loi Carrez surface certificate for co-owned apartments.

Advice: insist all diagnostics are current and include them as information in the compromis; if a diagnostic reveals work, cost out the remedy before completing.

5. Acquisition costs — what you will pay at closing

A. Resale / existing property (typical)

- Notary fees + transfer taxes (“frais d’acquisition”): normally ~7–8% of the purchase price (most of that is transfer tax; the notaire’s regulated fees are only a small share).

B. New build (VEFA)

- Notary/registration costs: reduced — typically 2–3% (plus VAT rules apply; the seller/promoter may include VAT in the asking price).

Other costs to budget

- Agency fees (if paid by buyer or seller depending on listing).

- Mortgage arrangement fees, valuation fees, bank guarantee or mortgage insurances.

- Renovation contingency (if buying older property).

- Annual property taxes: taxe foncière (owner pays) and possibly taxe d’habitation for certain usages (changes over time). Taxe foncière is an annual local tax based on cadastral value — all owners pay it.

6. Taxes on ownership, rental income and sale

- Taxe foncière (annual): paid by owner, amount varies by commune and property characteristics.

- Rental income: non-resident owners are taxed on French-source rental income; rates and allowances depend on regime (micro-foncier vs real regime) and residency. Non-residents face minimum withholding/tax rules (minimum rates may apply).

- Capital gains tax (CGT) on sale: standard rate for non-residents is 19% on gains plus social contributions (social charges) historically adding ~17.2% (with reduced rates for EU/EEA residents in certain cases); main residence exemptions apply for residents and under conditions. There are tapering reliefs by length of ownership. Always check current rates and exemptions with a tax adviser.

- IFI (real-estate wealth tax): IFI applies if net real-estate assets in France exceed €1.3 million on 1 January; non-residents are liable on French real estate only.

Note: French tax law changes frequently. Use a French tax specialist for precise impact modelling before purchase.

7. Financing: mortgages for non-residents

- French banks lend to non-resident buyers, but terms differ from resident mortgages: typical LTV for non-residents is ~70–80% (75% common), though some lenders require higher deposits depending on nationality and documentation. Some banks ask for 30–40% contribution from non-residents. Documentation (proof of income, bank statements, tax returns, credit history) and life/insurance requirements apply. A French mortgage is often the easiest route for long-term hold strategies.

Practical steps: prepare translated & certified documents, open a French bank account if needed, obtain mortgage in principle early, and build a clear financing contingency into the compromis.

8. Ownership structures and tax planning

- Personal ownership (natural person): simplest; straightforward taxes and registration. Good for smaller portfolios or personal use.

- SCI (Société Civile Immobilière): common for foreign investors who want flexible succession planning, easier transfer of shares, joint ownership or rental management through a French company. SCIs require annual accounts and administration. They may be useful for estate planning and certain tax strategies, but they also add complexity (accounting, governance) and can have different tax consequences on sale. Foreign buyers should check home-country treatment of SCI shares.

Advice: evaluate SCI vs personal ownership with a French notaire and tax adviser before finalising the acquisition.

9. Risk areas and how to manage them

- Hidden defects / incomplete diagnostics: insist on a complete DDT and, for major projects, commission an independent survey.

- Copropriété (condominium) issues: obtain the complete copro documents (minutes of meetings, carnet technique, budget, charges, planned works). Large or pending travaux can materially change economics.

- Financing failure: always include a mortgage condition precedent and have backup financing options. If mortgage is refused but clause is missing, deposits can be forfeited; ask for multiple refusal letters as proof if needed.

- Regulatory/tax changes: monitor national and local tax proposals (local transfer duty adjustments, IFI reforms) — consult a tax adviser before closing.

10. Renting, management and returns

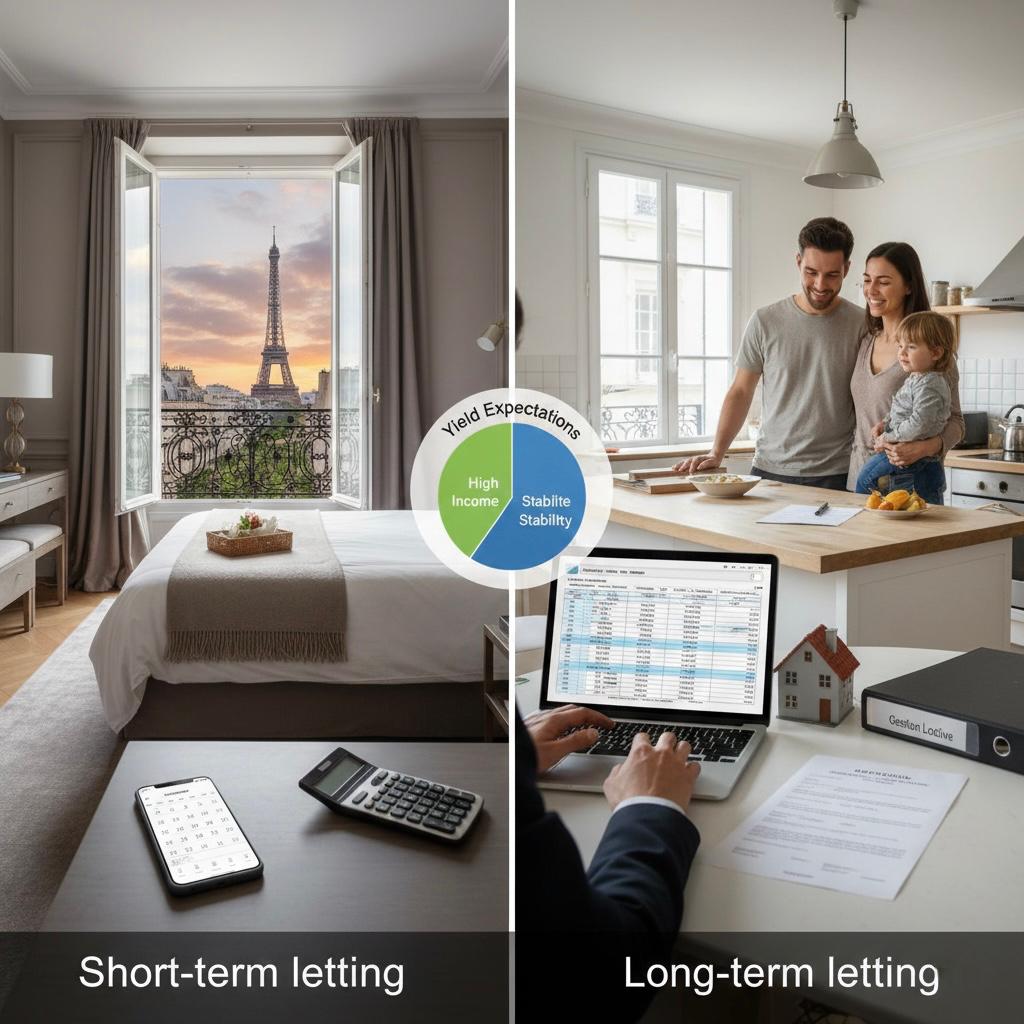

- Short-term vs long-term letting: both widely used in France — short-term (holiday) rentals can generate higher income but face local regulations (some cities require registration or limit let-days). Long-term leases offer more stability and simpler tax treatment.

- Yield expectations: vary by city and asset class. Net yield must be modelled after acquisition costs, annual taxes, running charges, insurance, management fees and vacancy. Use conservative assumptions and test downside scenarios (higher vacancies, unexpected works).

- Property management: if you are off-market, budget for a professional manager to handle letting, maintenance and legal obligations.

11. Practical checklist before you sign anything

- Secure an independent mortgage pre-approval or proof of funds.

- Request full Dossier de Diagnostic Technique (DDT) and verify recent dates.

- Obtain complete copropriété documents if apartment (last 3 years’ accounts, outstanding travaux).

- Insist on a mortgage clause and other suspensive clauses (permits, clear title).

- Budget acquisition costs: ~7–8% for resale, ~2–3% for new builds (notary/transfer fees).

- Plan 6–12 months operating reserve for unexpected works / vacancy.

- Check rental regulation for the municipality (especially for short-term rentals).

12. How Home France (or a specialist agent) can add value

Local sourcing and vetting of properties, fluent handling of French legal & notarial process, translation of documents, coordination of diagnostics, project management for renovations, mortgage introductions and tax advisers. Use local specialists to reduce transactional friction and legal/tax risk.

Conclusion

Buying property in France remains one of the most reliable and structured investment options in Europe for international investors. France offers a transparent legal framework, strong buyer protections through the notarial system, and a mature real estate market supported by long-term economic stability. Whether the objective is capital preservation, rental income, or long-term asset growth, the French property market provides a wide range of opportunities across major cities and regional markets.

Successful investment, however, depends on a clear understanding of the full purchase process, associated costs, taxation, and ongoing ownership obligations. Careful due diligence, realistic financial planning, and awareness of local regulations are essential to mitigating risk and maximizing returns. Working with experienced, locally based professionals such as Home France allows investors to navigate the French real estate market with confidence and make informed decisions aligned with their investment goals.

Comments

Add a comment

Leave a Reply · Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed.