Property Taxes in France: What International Buyers Need to Know

- Investment

-

Jan 28

- Share post

French Property Taxes Explained

A Complete Guide for Foreign Investors

Buying Property in France: Taxes, Costs, and Investment Rules

Investing in real estate in France remains one of the most attractive options for international investors seeking long-term capital preservation, rental income, and exposure to a stable European market. However, beyond location and property type, taxation is a decisive factor in determining the true performance of a French property investment.

This guide provides a clear, investor-focused overview of French property taxes, from acquisition to ownership, rental income, and resale, with a strong emphasis on tax optimization strategies for non-resident investors.

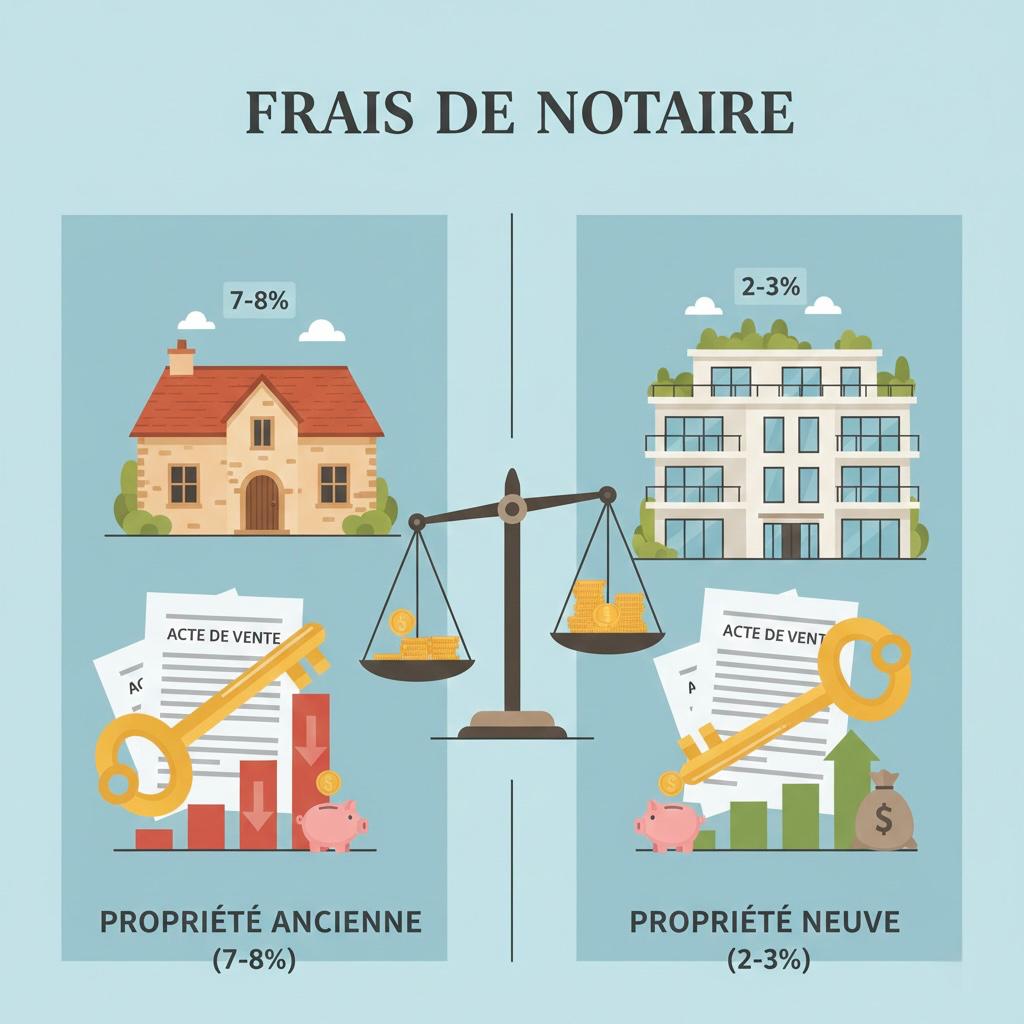

1. Property Acquisition Costs in France (Frais de Notaire)

When buying property in France, acquisition costs—commonly referred to as Frais de Notaire—are paid by the buyer. These costs include transfer taxes, registration fees, and the notary’s regulated remuneration.

The total amount depends primarily on whether the property is new or resale:

Resale Properties (Existing Real Estate)

For existing properties, total acquisition costs typically range between 7% and 8% of the purchase price. The majority of this amount consists of government transfer taxes rather than notary fees themselves.

New Properties and Off-Plan Purchases (VEFA)

One of the major advantages of investing in new-build property in France is the significantly reduced acquisition cost. Notary fees for new properties generally range between 2% and 3%, substantially lowering the investor’s initial capital outlay and improving overall return metrics.

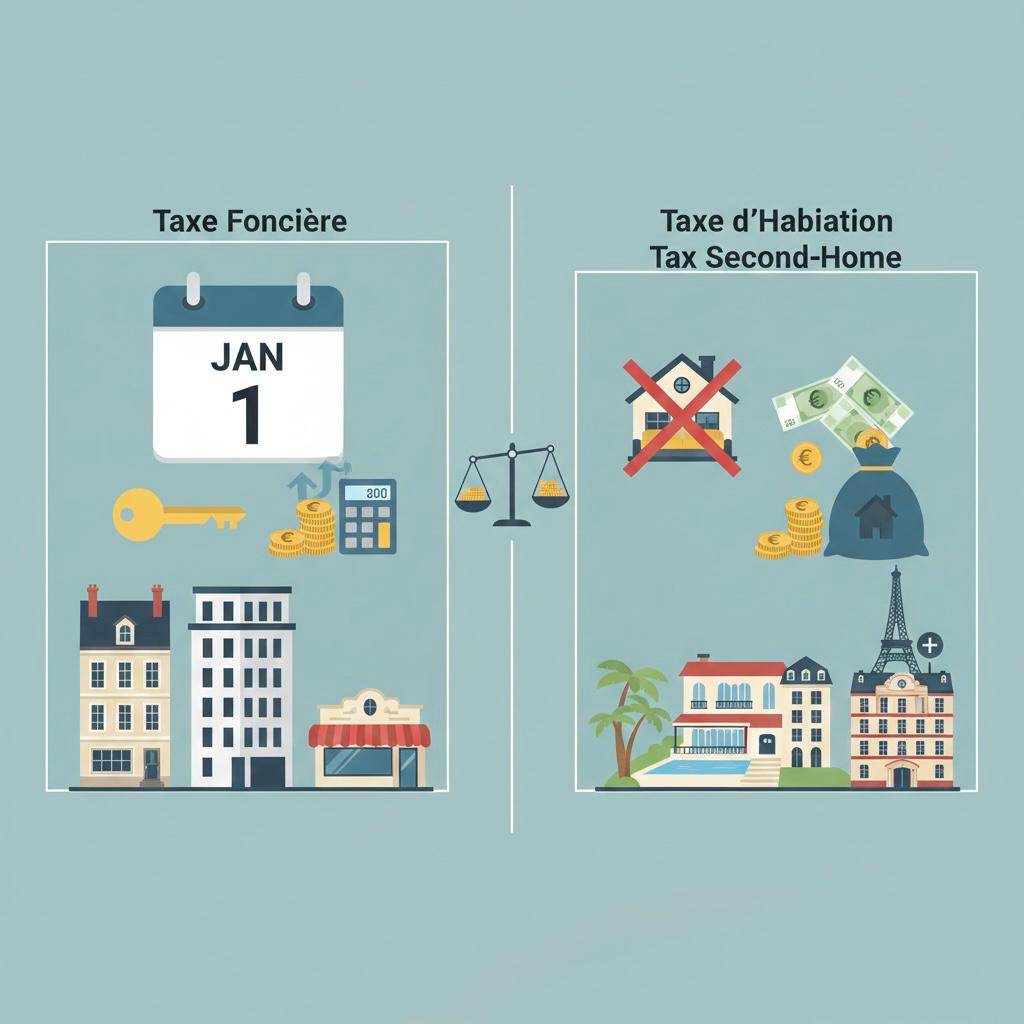

2. Annual Property Taxes in France

Once ownership is established, investors are subject to local annual property taxes. These taxes vary by municipality and property usage.

Taxe Foncière (Property Ownership Tax)

The Taxe Foncière is payable by the legal owner of the property as of January 1st each year. It applies to all properties—residential or commercial—and is calculated based on the cadastral rental value determined by local authorities.

Taxe d’Habitation (Second-Home Tax)

While Taxe d’Habitation has been abolished for primary residences, it still applies to second homes and investment properties. In high-demand markets such as Paris, Nice, or parts of the French Riviera, local authorities may impose a surcharge to discourage vacant properties.

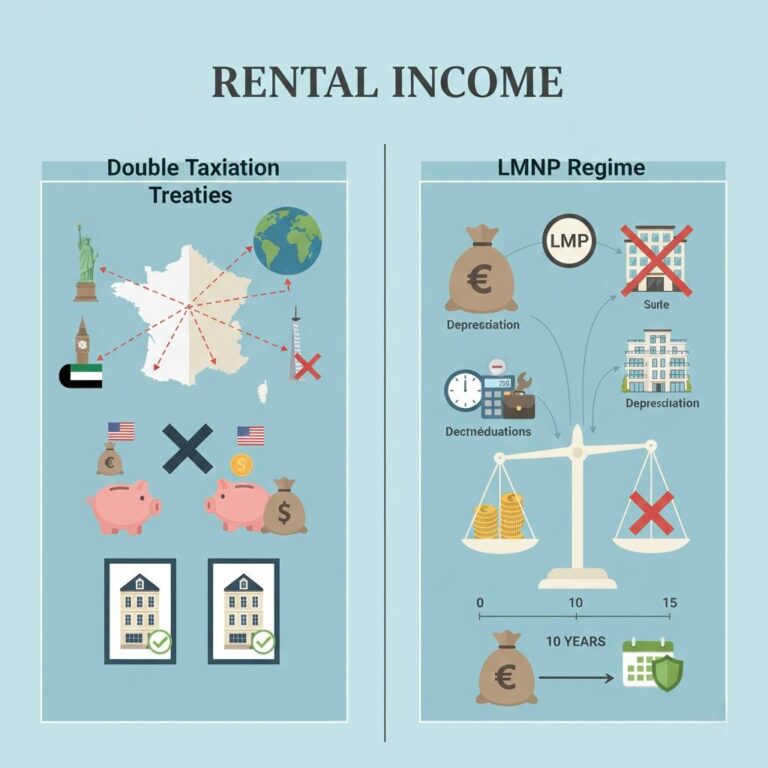

3. Rental Income in France and Double Taxation Treaties

France has signed Double Taxation Agreements (DTAs) with more than 100 countries, including the United States, the United Kingdom, the UAE, and Saudi Arabia. These treaties ensure that rental income generated in France is not taxed twice in the investor’s country of residence.

LMNP: The Preferred Rental Tax Regime for International Investors

The LMNP (Loueur en Meublé Non-Professionnel) regime is one of the most powerful tax optimization tools for foreign investors purchasing rental property in France.

Under the LMNP framework:

- The value of the building (excluding land) and furniture can be depreciated over time

- Operating expenses such as management fees, insurance, maintenance, and professional services are deductible

- Depreciation often offsets taxable rental income entirely

In practice, many international investors pay little to no income tax on French rental income for 10 to 15 years, while remaining fully compliant with French tax law.

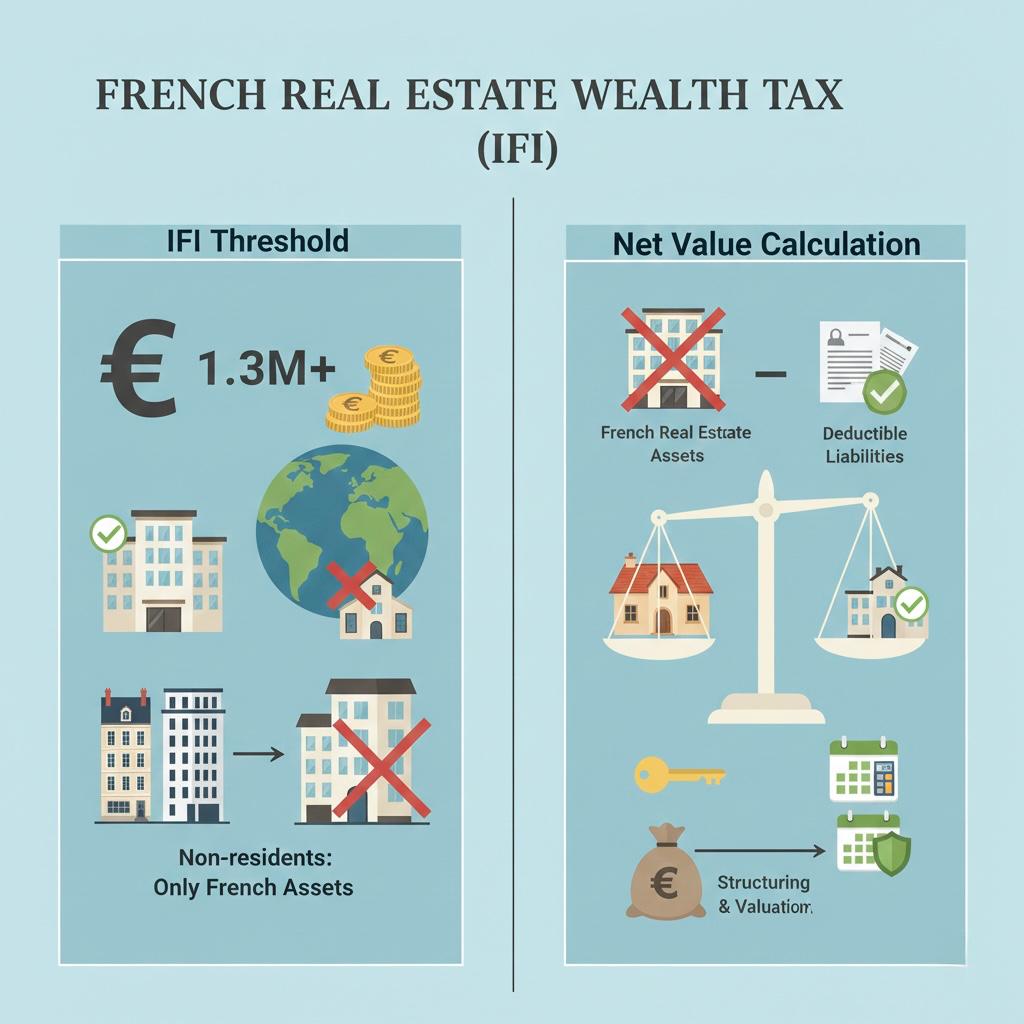

4. French Real Estate Wealth Tax (IFI)

France applies a Real Estate Wealth Tax (Impôt sur la Fortune Immobilière – IFI) to individuals whose net French real estate assets exceed €1.3 million.

Key points for international investors:

- Only French real estate assets are considered for non-residents

- The tax is calculated on the net value, after deducting eligible liabilities

- Proper structuring and valuation can significantly reduce IFI exposure

For high-net-worth investors, early tax planning is essential to avoid unnecessary wealth taxation.

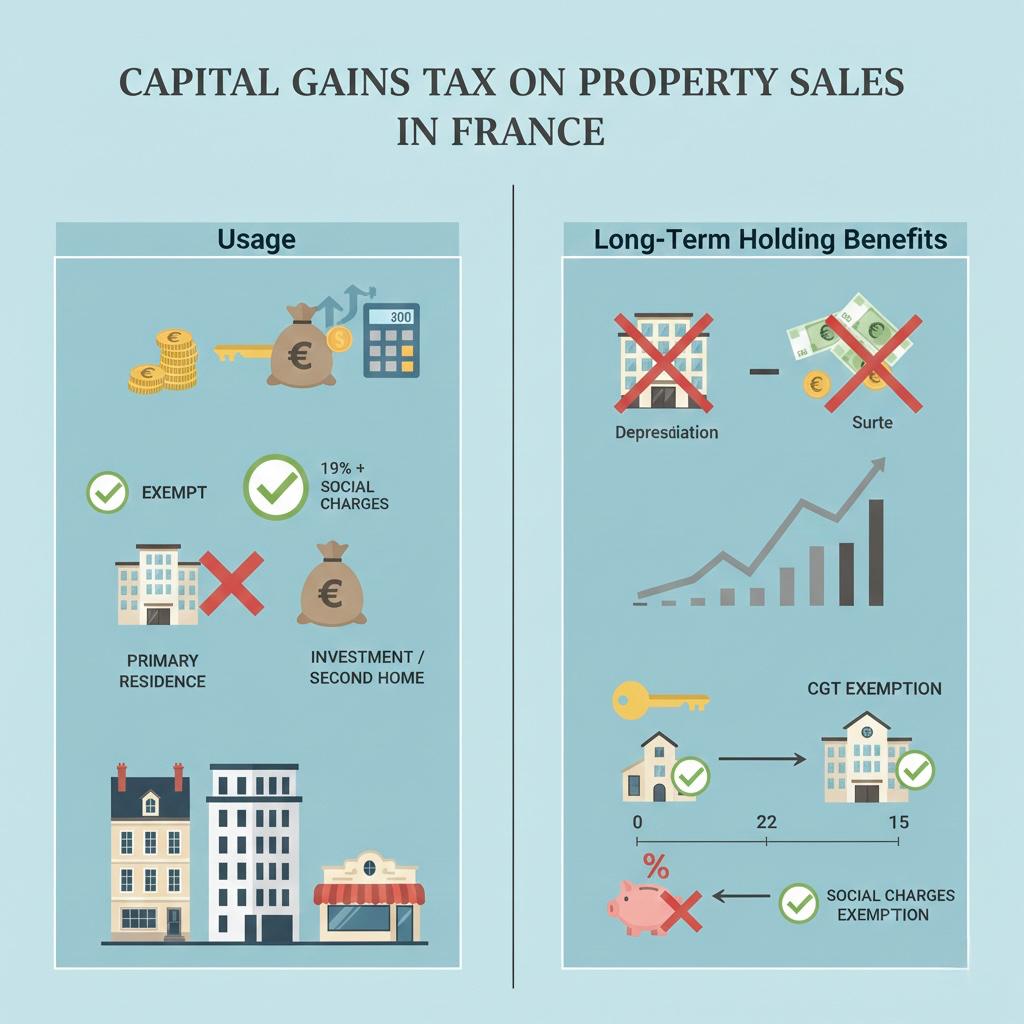

5. Capital Gains Tax on Property Sales in France

Capital Gains Tax (CGT) applies when selling property in France, depending on usage and holding period.

- Primary Residence: Fully exempt from CGT

- Investment or Second Home: Subject to a base CGT rate of 19%, plus applicable social charges

Long-Term Holding Benefits

France offers generous tapered relief for long-term investors:

- Full exemption from CGT after 22 years of ownership

- Full exemption from social charges after 30 years

This structure strongly incentivizes long-term property investment strategies.

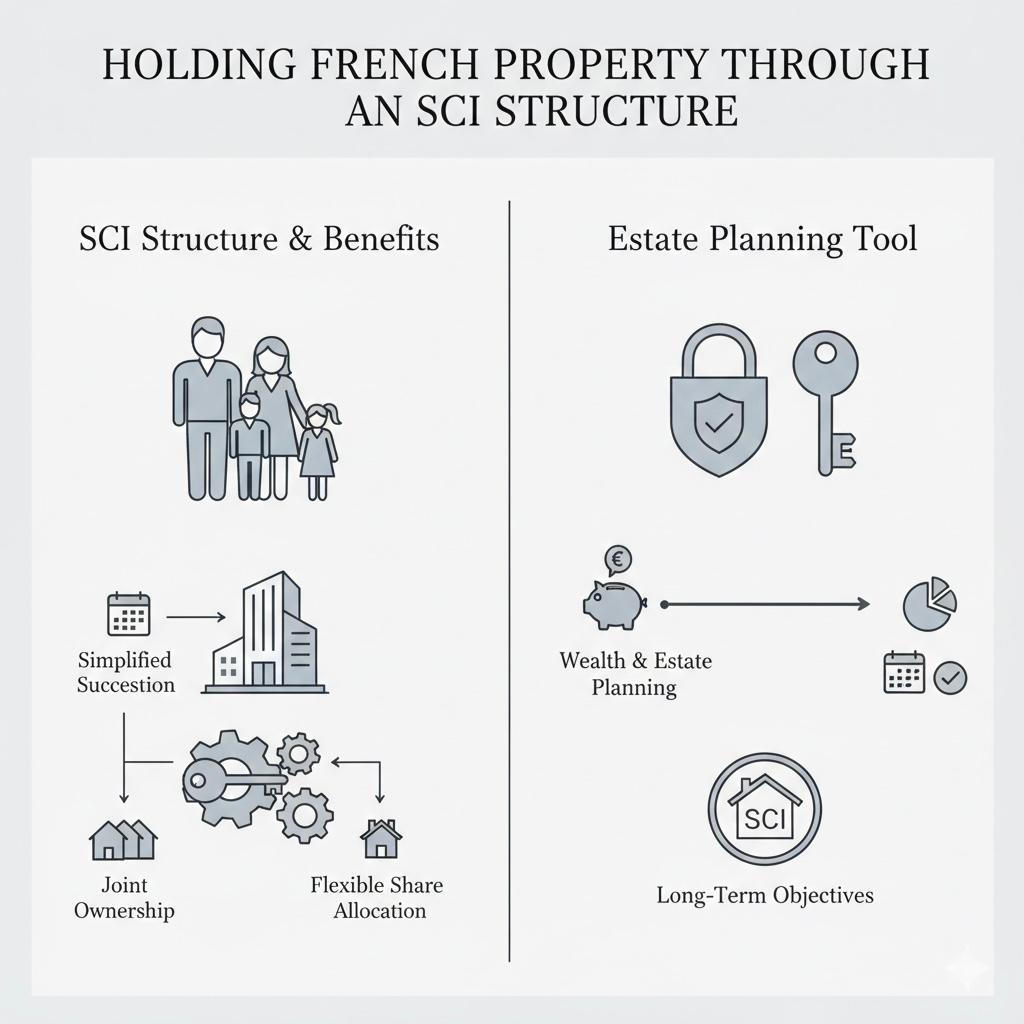

6. Holding French Property Through an SCI Structure

Many international investors choose to acquire property through a Société Civile Immobilière (SCI), a French real estate holding company.

An SCI can offer:

- Simplified inheritance and succession planning

- Easier management of jointly owned family assets

- Flexible ownership allocation through shares

While not suitable for every investor, an SCI can be highly effective when aligned with long-term wealth and estate planning objectives.

Strategic Tax Planning: Why Professional Guidance Matters

French property taxation is transparent but highly technical. Small structural decisions—such as choosing between furnished or unfurnished rental, personal ownership or SCI, or resale timing—can materially affect long-term returns.

Home France supports international investors with:

- Access to experienced bilingual tax advisors and Notaires

- Strategic guidance on LMNP and ownership structuring

- Market-driven advice aligned with investment objectives, not generic solutions

Conclusion

Understanding French property taxes is essential for any investor seeking to maximize returns and protect capital in the French real estate market. With the right strategy, France offers not only stability and transparency but also exceptional tax efficiency for informed international investors.

A structured, well-advised approach transforms French real estate from a simple purchase into a high-quality, long-term investment asset.

Comments

Add a comment

Leave a Reply · Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed.