Real Estate Investment in France

- Investment

-

Jan 26

- Share post

A Practical Guide to Choosing the Right Investment Strategy

New, Old, or Renovation Property in France?

Real Estate Investment in France: Which Strategy Should You Choose? New Apartment, Old Property, or Renovation Project

Welcome to the world of real estate investment in France. When you begin this journey, you will quickly realize that you are not facing just one or two options, but a range of investment strategies—each with distinct objectives, advantages, and risk profiles.

Do you prioritize stability and prime location by purchasing an existing apartment? Do you prefer efficiency, low maintenance, and peace of mind offered by a new-build property? Or are you ready to unlock hidden value by transforming an older property into a modern, high-yield asset?

In this analysis, we examine a realistic case study with concrete figures to clearly illustrate the financial implications of each strategy and help you identify the option that best aligns with your investment goals.

Establishing a Realistic Comparison: Case Study

To ensure clarity and practical relevance, let us assume the following scenario:

- Investor: You, seeking a rental-focused real estate investment

- Property Type: Two-bedroom apartment (T2), approximately 45 m²

- Location: Lyon, a major French city with strong rental demand

- Purchase Budget: Approximately €250,000

We will now analyze two primary options.

Option A: Existing Apartment (L’Ancien)

A character-filled 45 m² apartment located in an established, central, and upscale neighborhood within a traditional building.

Option B: New Apartment (Le Neuf / VEFA)

A modern apartment of identical size, located in a newly developed residential project within an emerging area offering good public transport access.

Section One: Initial Acquisition Costs

How Much Capital Do You Need Upfront?

This is where the most significant financial difference emerges, directly affecting your initial cash outlay and liquidity.

Option A: Costs of an Existing Apartment

- Purchase Price: €250,000

- Notary Fees (Frais de Notaire): Significantly higher for older properties. Typically ranging between 7% and 8%, we apply a realistic average of 7.5%, resulting in €18,750.

- Estimated Renovation Costs: €15,000 for kitchen, bathroom, and cosmetic upgrades to attract quality tenants.

Total Initial Capital Required: €283,750

Option B: Costs of a New Apartment

- Purchase Price: €250,000

- Notary Fees: Reduced substantially for new-build properties, typically between 2% and 3%. Using a 2.5% average, the cost is €6,250.

- Renovation Costs: None. The property is delivered turnkey.

Total Initial Capital Required: €256,250

Cost Analysis

Choosing a new apartment results in €27,500 less capital required upfront. This difference can be redeployed into additional investments or retained as liquidity, making it a decisive factor for many investors.

Section Two: Cash Flow and Net Rental Income

How Much Profit Remains Annually?

Option A: Rental Performance of an Existing Apartment

- Estimated Monthly Rent: €900

- Gross Annual Income: €10,800

- Ongoing Monthly Costs: Approximately €200 (maintenance, insurance, taxes)

- Net Annual Income (before income tax): €8,400

Option B: Rental Performance of a New Apartment

- Estimated Monthly Rent: €850

- Gross Annual Income: €10,200

- Ongoing Monthly Costs: Approximately €100, due to energy efficiency and reduced maintenance. New properties also benefit from two years of exemption from property tax (taxe foncière).

- Net Annual Income (before income tax): €9,000

Net Yield Comparison

- Existing Apartment: €8,400 / €283,750 ≈ 2.96%

- New Apartment: €9,000 / €256,250 ≈ 3.51%

Financial Insight

Despite slightly higher rent for the older apartment, the new property delivers higher net income and superior yield, driven by lower acquisition and operating costs.

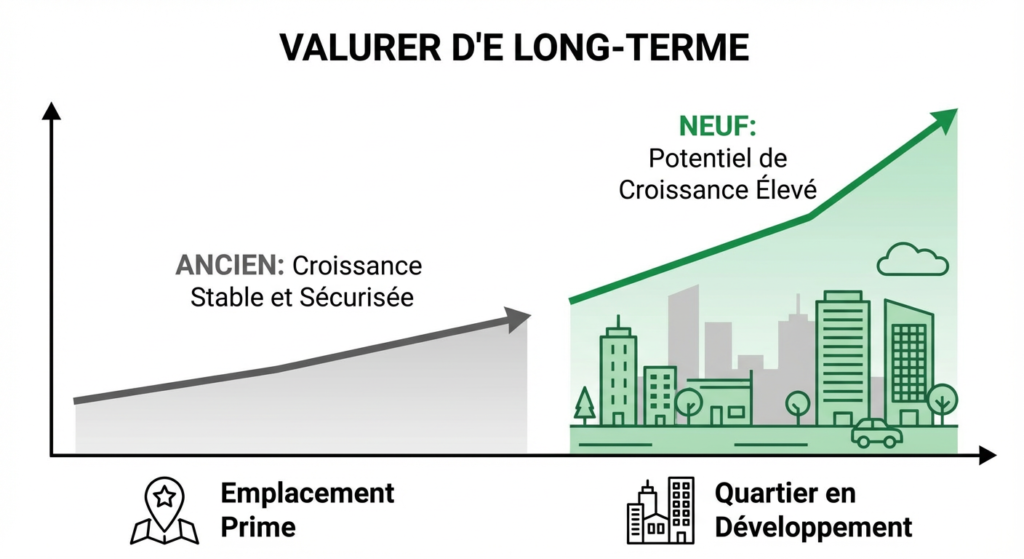

Section Three: Capital Growth and Risk Profile

Existing Apartment: Stability and Proven Value

Strengths:

- Stable and predictable price appreciation

- Prime, well-established locations

- Strong resale liquidity due to architectural character

Limitations:

- Moderate capital growth

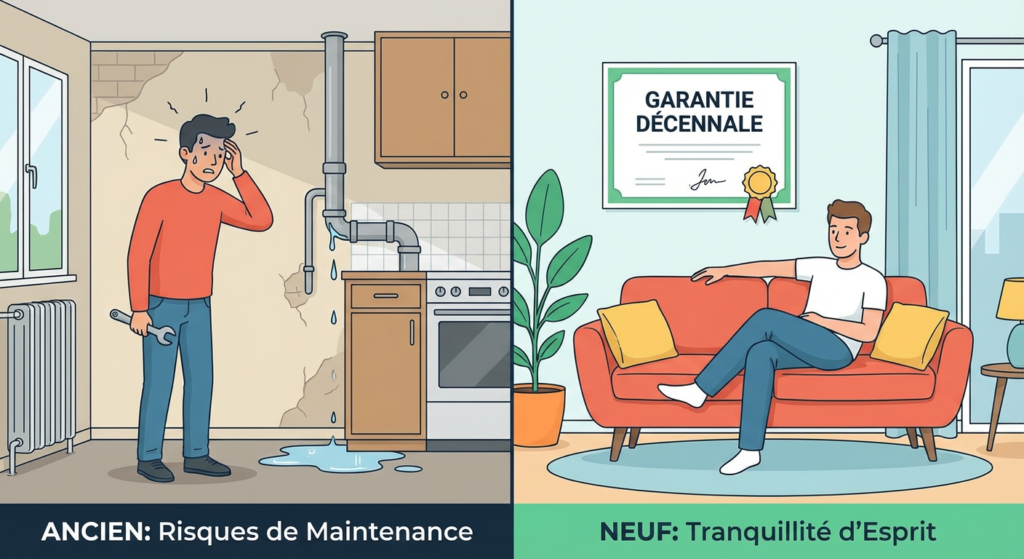

- Exposure to unexpected maintenance expenses (elevators, roofing, heating systems)

New Apartment: Growth Potential and Peace of Mind

Strengths:

- Potential for significant capital appreciation in developing areas

- Covered by the ten-year structural warranty (Garantie Décennale)

- Minimal maintenance risk

Limitations:

- Capital growth depends on successful neighborhood development

This rental income can serve two strategic purposes. First, it may contribute to meeting the financial independence requirements for residency applications. Second, it provides a stable income stream that complements long-term capital appreciation. As a result, property ownership in France is widely viewed as a dual-benefit strategy combining immigration planning with conservative investment principles.

Conclusion: Which Investor Are You?

There is no universally “correct” option—only the strategy that best suits your profile.

Choose a new apartment if you:

- Focus on maximizing net yield and cash flow

- Want lower upfront capital requirements

- Value peace of mind and minimal risk

Choose an existing apartment if you:

- Prioritize prime central locations

- Seek long-term stability

- Prefer a hands-off investment approach

Choose a renovation strategy if you:

- Aim to create value through active investment

- Seek higher rental returns and capital growth

- Want to benefit from powerful tax mechanisms

Selecting the right strategy requires expert guidance. Whether you are considering a new-build property, an existing apartment, or a renovation project, Home France provides specialized advisory services tailored to international investors in the French real estate market.

Final Insight: The Hidden Opportunity in French Cities

Most buildings in historic French city centers are older by nature. While this may initially appear as a drawback, experienced investors recognize it as a strategic advantage.

The Buy, Renovate, Rent strategy allows investors to immediately increase property value, command higher rents, and benefit from the Déficit Foncier tax mechanism, which permits renovation costs to be deducted from rental income—often resulting in several years of reduced or zero income tax.

This strategy requires deep local expertise, reliable renovation management, and a precise understanding of French regulations. Home France not only identifies high-potential properties but also manages renovation projects end-to-end, transforming older assets into modern, income-generating investments.

Comments

Add a comment

Leave a Reply · Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed.